Stripe vs Paddle - Differences, Pros, Cons & Use Cases

Table of Contents

Looking for a payment solution for your SaaS product? Stripe and Paddle are possibly the most popular choices at the moment. In this article we'll take a look at their differences, pros and cons and what would suit your business the best.

Differences between Stripe and Paddle

Paddle is a Merchant of Record (MoR) while Stripe is a payment processor.

To put it simply, merchants of record collect sales tax, handle refunds and take care of chargebacks for you for a small fee. Technically, they are the ones selling your product. Their name appears on the customer's invoice and credit card statement.

When using Paddle, you get a single invoice at the end of the month for all the sales you've made. This makes accounting much easier.

Pricing and Platform Fees

Both platforms charge a fee on every successful transaction. Stripe has additional fees if you use some of their extra services.

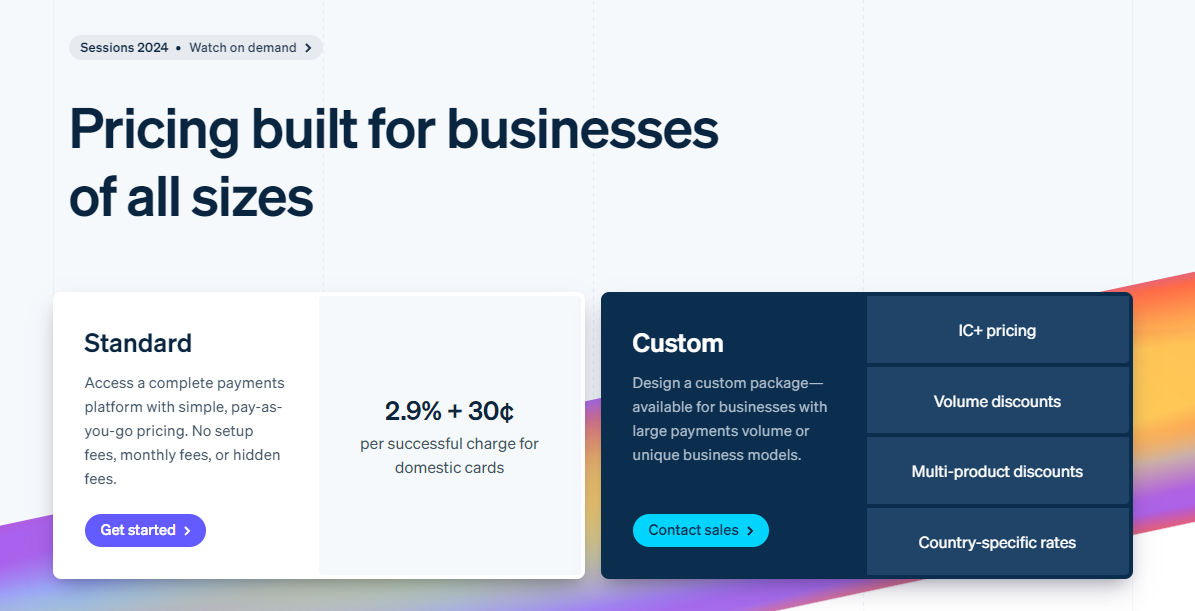

Stripe Fees

The standard fee for using Stripe is 2.9% + $0.30 per successful card charge. If your business is located in Europe, the fee is 1.5% + €0.25 for all cards in the European Economic Area (EEA).

There are additional fees for using a custom currency (1%), invoices (0.4%), tax collection (0.5%) and more.

Something to note is that Stripe does not refund the fees they charge after a refund or a chargeback occurs; Paddle, however, does.

You can find more information on their detailed pricing page.

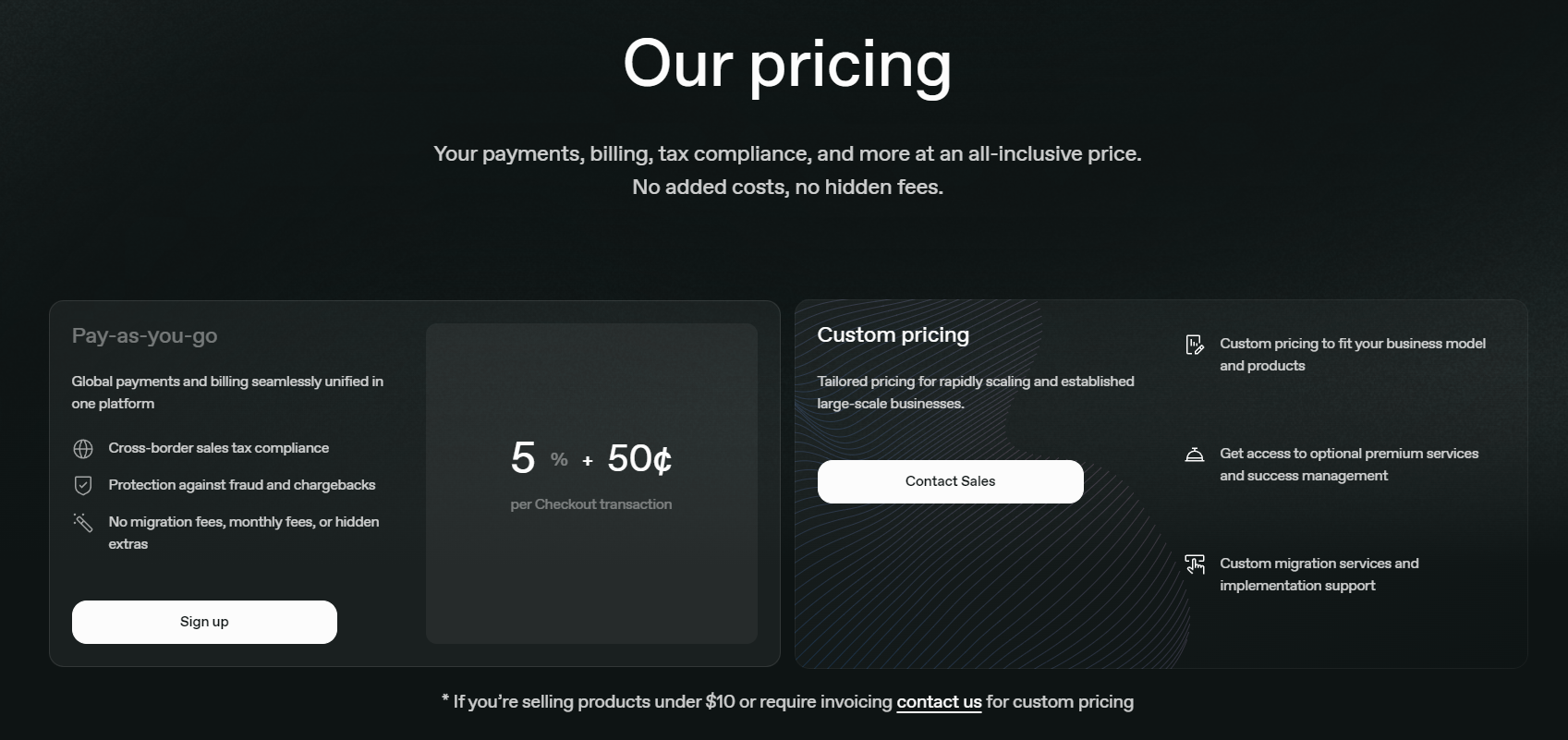

Paddle Fees

Paddle has a single fee for all they offer: 5% + $0.50 per transaction. This is for all of their services including tax collection and fraud protection.

You can also contact their sales team for custom pricing if you're selling products under $10 or require invoicing.

Developer Experience

Having worked with both Stripe and Paddle, I can safely say that Stripe has better developer experience. Their documentation is a lot more complete and Stripe, in general, has many more features.

Paddle has 2 different billing documentations:

- Paddle Billing

- Paddle Classic

Paddle Billing is the successor of Paddle Classic, aiming to improve the developer experience and introduce new features such as Paddle Retain - a churn reduction module for Paddle.

Use Cases

Both platforms have similar use cases, allowing you to achieve the same results regardless of your choice. Each has its own strengths and weaknesses.

SaaS apps - Paddle or Stripe

If you have a regular SaaS app with monthly or yearly subscriptions, both Stripe and Paddle can work wonders.

Stripe requires more customization and development effort, but offers much more flexibility. Paddle can be easier to setup because it offers everything out of the box.

Another huge plus for Paddle is that it takes care of (almost) all of your tax burdens, so if you don't own a company or don't want to pay for accounting, Paddle is a great choice.

Marketplace apps - Stripe

If you own a marketplace website where you want each user to be able to receive money, you should use Stripe Connect with standard accounts or Stripe Express.

The difference between those 2 is that Stripe Express handles all the onboarding and user verification for you. This eliminates the need for your users to have a standard Stripe account and makes the whole experience quick and easy.

Usage-based apps - Stripe

If you have an AI app with usage-based billing, Stripe offers several out-of-the-box usage-based pricing models:

- Per unit: Every unit of units costs x. For example, credits for an AI image generator.

- Per package: Every package of y units costs x. For example, you can have a plan that gives the user 2000 units every month.

- Volume-based pricing: Bill based on the volume of units used at the end of every period. For example, first 5 units cost 10$ each, then every next unit costs 7.5$ each.

- Graduated pricing: Similarly to volume-based pricing, this approach charges based on usage in each tier rather than applying a fixed price for all usage.

You can learn more about these pricing models on the Stripe docs.

E-Commerce - Stripe

For E-Commerce, I would recommend Stripe, as it's way more likely to be supported in your software (ex. Shopify or WordPress).

Stripe products are also very customizable and Stripe Checkout offers a more familiar user experience for your customers.

Did you know?

Shopify is built on Stripe and uses the same fee model as Stripe (on top of a monthly payment plan).

Conclusion

Both Stripe and Paddle are great choices. In the end, it really depends on your specific business needs and legal requirements.

Stripe offers deep customization, flexibility and the developer experience is great, perfect for complex integrations and tailored billing.

Paddle simplifies the whole billing process by handling sales tax, refunds and chargebacks, ideal for business who need an all-in-one payments solution with minimal legal effort.